The essentials in 30 seconds

Mirror surveys are a method that compares customer perceptions with those of your employees based on the same service criteria. They reveal discrepancies in perception (overestimation, underestimation, consensus) and become a powerful internal communication tool for aligning your teams with the actual customer experience. This is particularly effective in the hospitality and restaurant industry for identifying strengths to leverage and priority areas for improvement.

Customer satisfaction mirror survey: everything you need to know

What is a mirror investigation?

Mirror surveys are an evaluation method that asks the same questions to customers and employees of an establishment. They measure how your teams perceive the customer experience they provide, then compare it with the actual customer perception .

Unlike a traditional customer satisfaction survey (which only questions customers), the mirror survey creates a dialogue between two perspectives: that of those who experience the service on a daily basis and that of those who receive it.

Simple example: You ask customers: “Did you find the staff welcoming?” and employees: “Do you think you were welcoming?” The answers often reveal surprises.

How does a mirror survey work? The 3 key steps

Step 1: Customer Survey

You ask your customers about their actual experience: reception, cleanliness, quality of service, responsiveness, atmosphere, etc. The questionnaire is anonymous and neutral.

Step 2: Employee Survey

You ask your teams exactly the same questions , but rephrased: “Do you think customers find the staff welcoming?” Employees answer anonymously, without pressure.

Step 3: Comparison and analysis

You compare the two sets of responses to identify the discrepancies. That’s where the magic happens: you discover where your teams are mistaken about their own performance.

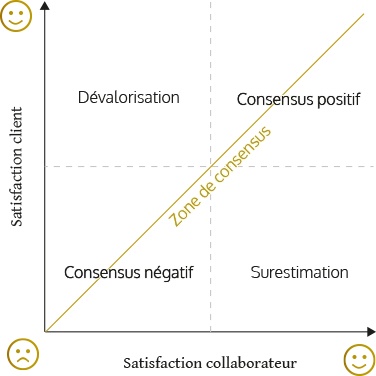

The 4 categories of results: understanding the discrepancies

Analyzing a mirror survey always produces four types of results. Here’s how to interpret them:

| Category | Definition | Example | Action |

|---|---|---|---|

| Positive consensus | Both customers and employees are satisfied. | “The staff is welcoming”: 85% of customers, 82% of employees | ✅ To value this strength internally and externally |

| Negative consensus | Customers AND employees identify a problem | “Waiting times are short”: 35% of customers, 38% of employees | 🔧 Priority improvement (everyone knows this) |

| Overestimation | Employees believe they are better than they actually are | “Room cleanliness”: 60% of guests, 85% of staff | ⚠️ Raising awareness among teams about the reality |

| Devaluation | The employees underestimate themselves | “Breakfast quality”: 78% of customers, 45% of employees | 💡 Recognize the real work of the teams |

Why implement a mirror survey?

1. A powerful internal communication tool

The mirror survey doesn’t judge; it reveals. When employees see that clients genuinely appreciate their work (devaluation), their motivation increases. When they discover they’re wrong about something (overestimation), they accept feedback more readily.

2. Involve and raise awareness among the teams

Participating in the survey (as a respondent) raises awareness . Employees realize they are being listened to and that their perspective is valued. This is an often underestimated lever for engagement.

3. Identify the differences in perception

You discover where your teams are going wrong. These discrepancies are points of friction : if everyone thinks it’s good but the customers say the opposite, it’s a warning sign.

4. Driving change with data

Instead of saying, “We need to improve the customer service ,” you say, “Customers find the service average (52%), but you think it’s good (71%). Here’s how we can bridge these two perceptions.” Data makes change less abstract.

5. Strengthen the customer culture

The mirror survey reminds everyone that the customer is at the heart of the business . It creates a conversation around the customer experience, not just the numbers.

Specific advantages for the hotel and restaurant industry

Hotel sector:

- Determine if the staff truly understand what customers are looking for (comfort, cleanliness, discretion, friendliness?)

- Aligning the teams (reception, housekeeping, catering) on a common vision of quality

- Identify strengths to highlight in marketing (if there is a positive consensus on the reception, it’s a selling point)

Restaurant sector:

- To measure whether the wait staff correctly perceive the quality of the food and service

- Identify the discrepancies between the chef’s vision and that of the customers

- Improving cohesion between the kitchen and the dining room (often two different worlds)

Tourist establishments (museums, parks, etc.):

- Evaluate whether the educational/game-based experience actually works

- Align the reception and entertainment teams with actual expectations

How to analyze the results of a mirror survey?

1. Calculate the differences

For each criterion, subtract customer perception from employee perception. A difference of more than 15 points warrants attention.

2. Classify by impact

- Negative consensus = urgency (everyone sees the problem)

- Overestimation = risk (the teams don’t see the problem)

- Devaluation = opportunity (valuing real work)

- Positive consensus = strength (to maintain and communicate)

3. Identify the patterns

- Are all employees mistaken on the same point? → Systemic problem

- Is only one team making a mistake? → Internal communication problem

- Are the discrepancies related to a lack of training? → Training plan

4. Implement corrective actions

For each significant difference, define:

- What : the exact problem

- Why : the root cause

- Who : responsible for the action

- When : deadline

- How to : measure progress

5. Communicate the results internally

Don’t keep the results to yourself. Present them to the teams in a positive way:

- “You thought the service was average, but the customers find it very good: well done!”

- “We thought cleanliness was our strength, but customers find it average: we have to do something about it.”

Mirror survey vs mystery shopper visit: what’s the difference?

These two methods are complementary , not competing. Here’s how to distinguish between them:

| Criteria | Mirror investigation | Mystery visit |

|---|---|---|

| Who is evaluating? | Real customers + employees | Mystery shopper (professional evaluator) |

| Objective | Compare perceptions | Observe the actual service in action |

| Data | Subjective (opinions) | Objectives (observed facts) |

| Cost | Moderate | Higher |

| Frequency | Can be regular | Usually annual or semi-annual |

| Result | Differences in perception | Accurate quality diagnosis |

| Example | “Do you think the reception is good?” | An evaluator actually tests the reception and notes every detail. |

Complementarity:

- The mirror survey reveals discrepancies in perception (where your teams are mistaken)

- The mystery visit reveals the reality on the ground (what’s really happening)

Together they offer a complete view: you know what customers think, what your teams believe, AND what is really happening.

Concrete example: mirror survey in a 3-star hotel

Context: Urban hotel, 80 rooms, team of 25 people (reception, housekeeping, catering).

Results of the mirror survey:

| Criteria | Customers | Collaborators | Gap | Category |

|---|---|---|---|---|

| Welcome at reception | 78% satisfied | 85% believe they are welcoming | -7 | Positive consensus |

| Room cleanliness | 62% satisfied | 88% think it’s clean | +26 | Overestimation |

| Breakfast | 81% satisfied | 55% think it is good | -26 | Devaluation |

| Service responsiveness | 45% satisfied | 48% believe they are responsive | +3 | Negative consensus |

| General atmosphere | 75% satisfied | 72% think it’s good | -3 | Positive consensus |

Interpretation:

- Reception and atmosphere : known strengths, to be maintained

- Cleanliness : Cleaning staff overestimate their abilities. There’s a need for awareness and clearer standards.

- Breakfast : The teams underestimate themselves. Guests really enjoy breakfast, but the staff don’t realize it.

- Responsiveness : a problem known to all. Priority action: reorganize the processes

Actions implemented:

- Awareness meeting with the cleaning staff: highlighting discrepancies, defining visual standards

- Recognizing the breakfast team: showcasing positive results, creating pride

- Auditing responsiveness processes: identifying bottlenecks

- Quarterly follow-up: repeat the survey to measure progress

Mistakes to avoid during a mirror survey

1. A questionnaire that was too long

If you ask 50 questions, respondents will get tired and answer haphazardly. Limit yourself to a maximum of 15-20 questions, focusing on the truly important criteria.

2. Lack of internal communication

If you don’t tell employees why you’re conducting this survey, they’ll see it as a hidden evaluation. Explain the purpose : to improve together, not to judge.

3. Superficial analysis

Don’t stop at “70% customer satisfaction.” Dig deeper : where are your teams going wrong? That’s where the value lies.

4. Lack of an action plan

An investigation without action is just numbers. Define concrete actions for each significant discrepancy, otherwise employees will lose trust.

5. Poorly managed anonymity

If employees fear their answers will be traced, they won’t answer honestly. Guarantee anonymity and make it clear.

6. Forgetting the context

A 60% satisfaction rate can be excellent in a difficult context (crisis, construction work) or poor under normal circumstances. Always contextualize the results.

7. Do not involve management

If management doesn’t believe in the survey, the teams will sense it. Involve managers from the start; have them participate in the analysis.

Frequently Asked Questions

Allow 4-6 weeks: 1 week of preparation, 2-3 weeks of collection, 1-2 weeks of analysis and reporting.

A minimum of 30 clients and 80% of your employees. The larger the number, the more reliable it is.

This is recommended to guarantee anonymity and impartiality. An external provider also creates more trust among respondents.

At least once a year. If you implement corrective actions, repeat the review after 6 months to measure progress.

Yes, it’s even recommended. Mirror surveys reveal discrepancies in perception, while mystery shopping confirms the reality on the ground.

Always be constructive. Focus on opportunities for improvement, not failures. Example: “Customers find our responsiveness average: this is our priority for the next 3 months.”

No, it complements it. The satisfaction survey measures actual satisfaction, the mirror survey measures the perception of discrepancies. Ideally, you do both.

In summary

The customer satisfaction mirror survey is much more than a poll: it’s an internal transformation tool . It reveals where your teams are going wrong with their own performance, creates a conversation around the customer experience, and provides data to drive change.

In the hotel and restaurant industry, it is particularly powerful for:

- To assemble teams that are often fragmented (reception, cleaning, kitchen, dining room)

- Identify the strengths to be valued (positive consensus)

- Detecting blind spots (overestimation)

- Motivating teams by valuing their actual work (devaluing)

Mirror surveys work best when combined with mystery shopping : one reveals perceptions, the other reveals reality. Together, they offer a 360° view of your customer performance.